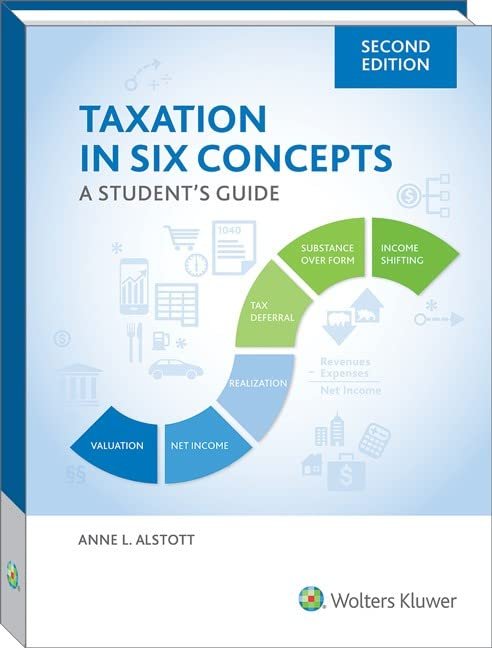

Taxation in Six Concepts: A Student’s Guide, 2019

Price: [price_with_discount]

(as of [price_update_date] – Details)

[ad_1]

Tax doctrines rest on a handful of concepts — just six, in fact. Armed with six concepts, you can decipher the law. In the United States, more so than in any other developed country, the tax law hosts many of the government s most important social and economic policies. Health care, housing, financial markets, education,and poverty, for example, involve tax. In short, tax turns out to host many interesting and pressing public policy problems. This book introduces the six concepts and uses them to unpack leading cases and real-world transactions. The six are valuation, net income, realization, tax deferral, substance over form and income-shifting. The cases discussed involve one (or two) of the six concepts discussed. This book also looks beyond the classroom. At every step, real-world transactions are included to show how tax planning harks back to the six concepts. Of course, tax law, like all law, is full of ambiguity and contradiction. Sometimes there is no single right answer. Courts reach conflicting decisions and use inconsistent reasoning. But the six concepts explain the conflicts within the law that give rise to ambiguity and uncertainty. The six concepts go a long way in understanding common tax-planning techniques, and the book explains common financial and real estate transactions. It includes a glossary of tax and business jargon, so you have a quick reference when a judicial opinion (or a client) invokes accelerated depreciation or nonrecourse debt.

Publisher : CCH Inc. (October 18, 2018)

Language : English

Paperback : 200 pages

ISBN-10 : 0808050915

ISBN-13 : 978-0808050919

Item Weight : 11.2 ounces

Dimensions : 6 x 0.5 x 8.75 inches

[ad_2]